As Monaco intensifies efforts to meet international standards in the fight against money laundering and terrorist financing, a new compliance-focused company has launched in the Principality to support local businesses navigating increasingly complex regulations…

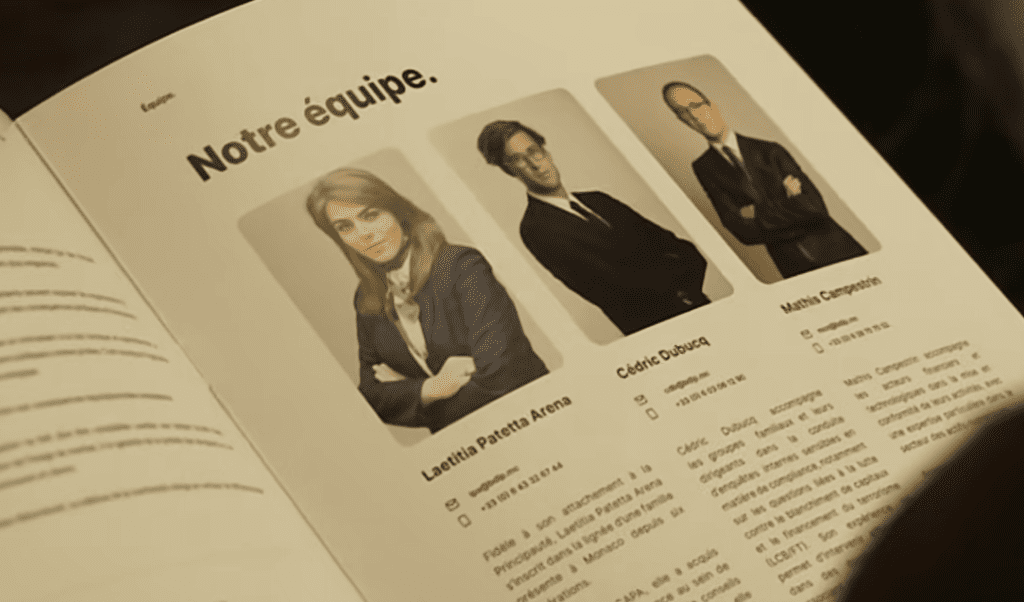

BD LP, an independent firm dedicated to regulatory compliance, aims to assist Monegasque entrepreneurs and institutions as the Principality works towards exiting the Financial Action Task Force (FATF) grey list. Established by three partners, the company offers specialised expertise to help organisations align with evolving international and national requirements.

The firm operates across both financial and non-financial sectors, reflecting the broad impact of compliance obligations. Its services target banks, asset management firms and insurance companies, as well as art galleries, real estate agencies, yacht-related businesses and small enterprises that must also meet strict regulatory standards. Through internal audits, risk mapping and the creation of tailored compliance procedures, BD LP supports companies seeking to strengthen their internal systems and avoid potential legal or financial exposure.

Training and advisory services form another core part of its offering, with dedicated programmes designed to raise awareness and improve understanding of compliance obligations among professionals. The firm also incorporates innovation and artificial intelligence tools to help businesses adapt to a rapidly changing regulatory environment.

The launch comes at a pivotal moment as Monaco continues implementing its 2025–2027 action plan to achieve full compliance with international frameworks and secure removal from monitoring lists. In this context, specialised support for businesses is increasingly viewed as essential to maintaining confidence and ensuring the Principality’s economic model remains both competitive and transparent.

Image: BD LP and Monaco Info